Thought I might reflect on attending Collision 2022 this week with my coworker Niloofar. I had to include the standard shot most people used, with a nod to Rodin’s – The Thinker. Felt strange attending an event with 35,000 people, 99+% of whom weren’t masked (myself included). A part of me felt like I might be part of something similar to the Sturgis Motorcycle Rally superspreader event in 2020. Somehow walking around in a crowd doing what everyone else is doing with only an occasional mask around as an uncomfortable reminder that CovId still is circulating felt okay. Mere days before I attended another coworker Mohammed’s convocation where everyone was masked sitting there for almost 3 hours. Interesting how as human beings we are more comfortable following the crowd, wherever it might be going. Full disclosure I am fully vaccinated and boosted but too young to get my fourth dose but perhaps I received that this week given the number of people there.

Which brings me to my musing on the nature of the 1,500 startups at Collision. I walked around one day trying to look at every single startup display which was probably 400 or so. Many of the 1,500 present got a day to put up a sign and talk with people as they walk around the hall. Somehow I felt like everyone was trying to create a digital closet organizer for different “problems” in our crowded lives. I didn’t realize we really need an app to help simplify changing our name or an Uber Eats for desserts. So much of what I saw felt like a derivate version of products that had already been successful. Most with a shelf life measured in a few years before they implode when consumer tastes change. Yet derivate companies seem to be what is driving startup culture. Don’t even get me started on why the world needs more cryptocurrencies but that situation seems to be getting resolved in the last few months.

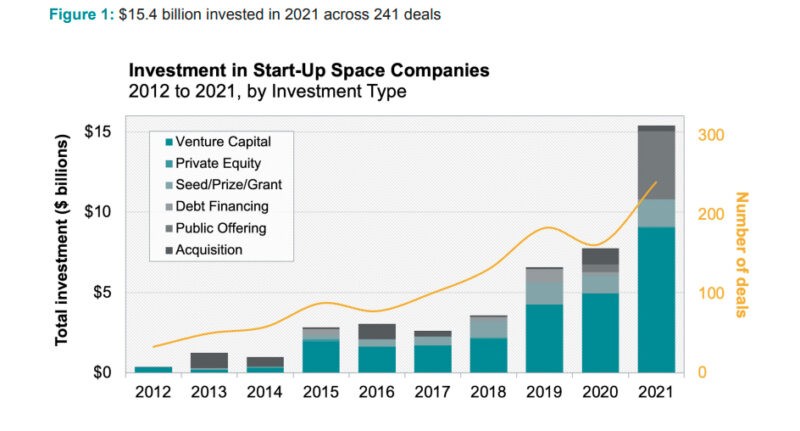

Even in an incredibly challenging industry like space launch companies investors seem to think that world needs even more startups that will somehow overtake a company like SpaceX. According to this article 2021 represented a record year, doubling the funding of the previous record year 2020 as even more companies enter the market. Do people really think that they can beat the Elon Musk, the world’s richest man; a workaholic relentlessly pursing a vision he has been chasing for over 20 years to get to Mars? He was willing to bet most of his fortune to the tune of $100M in 2005 without any success until the successful fourth Falcon 1 launch. Do you honestly think he is going to let another startup overtake him? This guy is flirting with buying Twitter for $44B because he needs a new hobby for goodness sake! Why do you think SpaceX is now into space tourists and low cost ride sharing for $1.1M? Additional revenue? Not a chance. He wants to make sure nobody else will pose a threat. He already has beaten the established titans of the industry. Maybe in 10 or 20 years a new opportunity will emerge but not now.

Basically innovation takes guts and courage, to sometimes be first at something that could fail. We had a number of great B2B meetings that were organized by Canada’s Trade Commission Service that were incredibly helpful for us. We got to meet with investors and trade officials from a number of countries which will be helpful for our future. Sometimes we would get asked a question that I have become used to: “Who are your competitors?” I understand the question and the reasons behind it but sometimes I wonder if the “correct” answer is really the right answer.

Would you invest in SpaceX in 2008 after the first successful Falcon 1 launch with a dummy payload after 3 failed launches when they faced no direct competitors in 2008? Would that have been a riskier investment than all these companies now trying to enter the market in 2021? At that point SpaceX had picked a market with no direct competitors, launching smaller payloads to orbit at a low price point. Something the established launch companies couldn’t be bothered with because it wasn’t profitable in their opinion and they couldn’t see the market expanding. SpaceX spent over $100M to obtain $7M in revenue for their first paying customer on their fifth launch. Now those same companies have no ability to compete and are years behind because they didn’t see the need to change until it was too late.

Collision 2022 was held at the Canadian National Exhibition a place where throughout it’s history world changing inventions were introduced. The first fair with electric street lights, the first electric railway, the first urban wind turbine in North America in 2002.

Of course innovating comes with risks. That wind turbine never generated the yields or returns promised. Major repairs were required in 2011 and 2017 through 2019 and it wasn’t spinning when we were there. However, that innovation sparked a transformation in the energy sector. That’s what innovation should do and should be rewarded! Is it riskier to invest in a company with no direct competitors or one chasing an industry leader still scaling up? Particularly if you are competing with 50 other startups also trying to catch that leader?

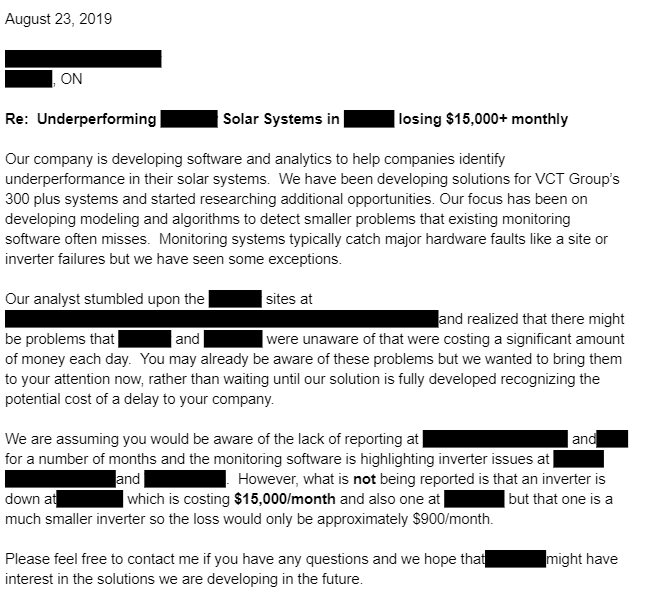

Innovation is risky but profitable if helping solve real problems facing society. By definition innovative companies are tackling problems that other’s aren’t addressing. So early in Boxbrite’s journey we surveyed the rapidly growing solar industry and examined systems that had been operating for a number of years. We discovered that many weren’t performing as expected and small and large losses were being missed. We were working towards a MVP while researching the industry and I ended up writing the letter you see when we stumbled upon a particular significant problem from a portfolio of almost 20 systems. I dropped it off at the company’s headquarters but never heard anything back.

Now three years later we still see the same problems emerging and I wrote an article showing how even publicly visible systems have unaddressed problems. During some of the meetings this week, I showed people a live demo in our platform of a small portfolio of two C&I systems that now in the last few weeks have 50% of the inverters off-line. Why? They had a generous 5 years parts and labor warranty from the installer but didn’t signup for ongoing O&M beyond that. The system uses a very popular inverter with a 12 year warranty. However, during the almost 7 years of operation they were experiencing a 20+% annual inverter failure rate, requiring replacement. So not surprising that 50% of inverters are now off-line. Losses during the last two years are now well over $50,000 and climbing rapidly. Even if nothing else breaks with 13 years of left on their FIT contracts the losses will easily exceed $1M. Eventually this will get fixed like the system I highlighted 3 years ago did. That system was fixed after losing approximately $60,000, the bill here will probably be much higher.

In walking around Collision and looking at all of the startups present I experienced two emotions. The first was frustration at all that talent, energy and money being focused on society’s problems that didn’t seem that important. The second was satisfaction that we still don’t have any competitors addressing this difficult problem that obviously needs to be solved! Why? I happen to agree with Peter Thiel’s talk that competition is for losers and I’m too competitive to enjoy losing. Sometimes you still end up losing when you innovate but I would rather innovate the follow the crowd.